Arrangement fee 3.00%

Applicable to all products listed

Commercial Investment

An award-winning combination of simple products and a specialist team to support your client’s complex transactions make us the specialist lender of choice for commercial mortgages.

Our products are typically used to purchase new investment properties, or to refinance existing properties or portfolios, but our offering also covers transactions of a more complex nature including vacant commercial, change of use, serviced offices, licences and short leases.

Specialist Lender of the Year - NACFB Awards 2021

Commercial Lender of the Year - B&C Awards 2020

Commercial & Semi-Commercial Investments

| LTV | 65% |

|---|---|

| Variable* | 9.64% |

| Fixed 2yr | 7.64% |

| Fixed 3yr | 7.59% |

| Fixed 5yr | 7.44% |

| Fixed 10yr | 7.44% |

| LTV | Variable* | Fixed 2yr |

Fixed 3yr |

Fixed 5yr |

Fixed 10yr |

|---|---|---|---|---|---|

| 65% | 9.64% | 7.64% | 7.59% | 7.44% | 7.44% |

*Shawbrook Base Rate (SBR)

| LTV | 65% |

|---|---|

| Variable* | 9.84% |

| Fixed 2yr | 7.94% |

| Fixed 3yr | 7.89% |

| Fixed 5yr | 7.74% |

| Fixed 10yr | 7.74% |

| LTV | Variable* | Fixed 2yr |

Fixed 3yr |

Fixed 5yr |

Fixed 10yr |

|---|---|---|---|---|---|

| 65% | 9.84% | 7.94% | 7.89% | 7.74% | 7.74% |

*Shawbrook Base Rate (SBR)

| LTV | 65% |

|---|---|

| Variable* | 10.54% |

| Fixed 2yr | 7.99% |

| Fixed 3yr | 7.94% |

| Fixed 5yr | 7.79% |

| Fixed 10yr | 7.79% |

| LTV | Variable* | Fixed 2yr |

Fixed 3yr |

Fixed 5yr |

Fixed 10yr |

|---|---|---|---|---|---|

| 65% | 10.54% | 7.99% | 7.94% | 7.79% | 7.79% |

*Shawbrook Base Rate (SBR)

| LTV | 65% |

|---|---|

| Variable* | 8.40% |

| Fixed 2yr | 6.69% |

| Fixed 3yr | 6.64% |

| Fixed 5yr | 6.49% |

| Fixed 10yr | 6.49% |

| LTV | 75% |

|---|---|

| Variable* | 8.65% |

| Fixed 2yr | 6.79% |

| Fixed 3yr | 6.74% |

| Fixed 5yr | 6.59% |

| Fixed 10yr | 6.59% |

| LTV | Variable* | Fixed 2yr |

Fixed 3yr |

Fixed 5yr |

Fixed 10yr |

|---|---|---|---|---|---|

| 65% | 8.40% | 6.69% | 6.64% | 6.49% | 6.49% |

| 75% | 8.65% | 6.79% | 6.74% | 6.59% | 6.59% |

*Shawbrook Base Rate (SBR)

| LTV | 65% |

|---|---|

| Variable* | 8.65% |

| Fixed 2yr | 7.29% |

| Fixed 3yr | 7.24% |

| Fixed 5yr | 7.09% |

| Fixed 10yr | 7.09% |

| LTV | 75% |

|---|---|

| Variable* | 8.90% |

| Fixed 2yr | 7.44% |

| Fixed 3yr | 7.39% |

| Fixed 5yr | 7.24% |

| Fixed 10yr | 7.24% |

| LTV | Variable* | Fixed 2yr |

Fixed 3yr |

Fixed 5yr |

Fixed 10yr |

|---|---|---|---|---|---|

| 65% | 8.65% | 7.29% | 7.24% | 7.09% | 7.09% |

| 75% | 8.90% | 7.44% | 7.39% | 7.24% | 7.24% |

*Shawbrook Base Rate (SBR)

| LTV | 65% |

|---|---|

| Variable* | 9.75% |

| Fixed 2yr | 7.34% |

| Fixed 3yr | 7.29% |

| Fixed 5yr | 7.14% |

| Fixed 10yr | 7.14% |

| LTV | 75% |

|---|---|

| Variable* | 10.25% |

| Fixed 2yr | 7.49% |

| Fixed 3yr | 7.44% |

| Fixed 5yr | 7.29% |

| Fixed 10yr | 7.29% |

| LTV | Variable* | Fixed 2yr |

Fixed 3yr |

Fixed 5yr |

Fixed 10yr |

|---|---|---|---|---|---|

| 65% | 9.75% | 7.34% | 7.29% | 7.14% | 7.14% |

| 75% | 10.25% | 7.49% | 7.44% | 7.29% | 7.29% |

*Shawbrook Base Rate (SBR)

Larger Loans

- Term loans from £5m to £35m

- Our Structured Real Estate team offer a premium case management service for Commercial loans over £5m, designed to deliver a personalised experience that meets the unique needs of your clients.

Structured Real Estate

Arrangement fee 3%

Applicable to all products listed

| LTV | 65% |

|---|---|

| Variable* | 9.64% |

| Fixed 2yr | 7.44% |

| Fixed 3yr | 7.39% |

| Fixed 5yr | 7.24% |

| Fixed 10yr | 7.24% |

| LTV | Variable* |

Fixed |

Fixed |

Fixed 5yr |

Fixed 10yr |

|---|---|---|---|---|---|

| 65% | 9.64% | 7.44% | 7.39% | 7.24%% | 7.24% |

*Shawbrook Base Rate (SBR)

| LTV | 65% |

|---|---|

| Variable* | 8.40% |

| Fixed 2yr | 6.54% |

| Fixed 3yr | 6.49% |

| Fixed 5yr | 6.34% |

| Fixed 10yr | 6.34% |

| LTV | 75% |

|---|---|

| Variable* | 8.65% |

| Fixed 2yr | 6.64% |

| Fixed 3yr | 6.59% |

| Fixed 5yr | 6.44% |

| Fixed 10yr | 6.44% |

| LTV | Variable* |

Fixed |

Fixed |

Fixed 5yr |

Fixed 10yr |

|---|---|---|---|---|---|

| 65% | 8.40% | 6.54% | 6.49% | 6.34% | 6.34% |

| 75% | 8.65% | 6.64% | 6.59% | 6.44% | 6.44% |

*Shawbrook Base Rate (SBR)

Commercial Investment Lending Criteria

We pride ourselves on being transparent with our lending criteria, so you know where you stand when submitting a case to us.

If your client does not meet all conditions, applications may still be considered.

You can explore our new, fully interactive Commercial Investment lending criteria or download as a PDF.

Criteria at a glance…

- First time commercial landlords?

- No, but we only require them to have one Buy-to-Let owned for one year+ and an FRI lease in place with 2 or more years to run before break/expiry

- Do you lend against Market Value (MV) or Vacant Possession (VP)?

- The lower of MV or VP value.

- Are vacant commercial units acceptable?

- Yes but where the property is part or fully vacant on completion, the borrower must evidence sufficient outside income to meet the loan payments.

Fast completions on complex cases.

We completed a £7m commercial investment refinance and capital raise within two working days of the offer being made.

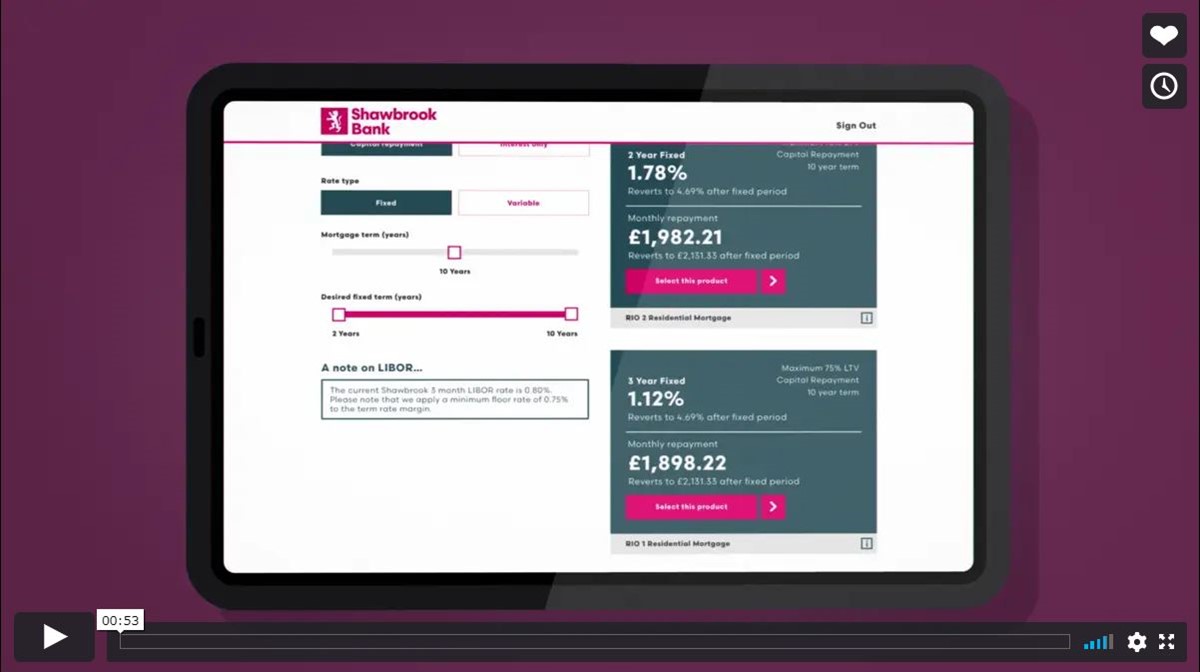

MyShawbrook Portal

The digital platform that takes the pain out of the product switch process.

Our Broker Flow Process Guide walks through the steps of this new, simple product switch portal.

We’re in it for the long haul.

We believe in the value of long-term relationships. That’s why we offer existing customers a 0.25% discount on the arrangement fee for anyone with an existing Shawbrook product applying for a new loan.

Latest Insights & News

Shawbrook Bank completes £670k semi-commercial investment mortgage in 14 working days

Shawbrook Bank significantly grows lending teams

Shawbrook Bank expands criteria for automatic property valuations

Property Investment Market remains optimistic in the face of continued Covid-related uncertainty

How can we help today?

Enquiry Form

For your safety, please do not send security details such as passwords by email.

Fields marked with an asterisk are mandatory.